Spontaneous machines look more expensive than this.

Sometimes, good news for stock investor may be good news for stock investor BuyerTake to the case of Spontaneous machines ,Lunar -3.52%,,

A month ago, I asked myself whether easy machines -a stock that I am already of myself – Can be worth purchasing Even more, after the price of its share, the price at which I first bought it almost doubled. Paying double the price for a lot of stock usually does not seem like a deal. In fact, after running a valuation on stock in May, I ended my condition and argued It is possible Be worth buying Yet it seems that I cost more than what I believe. An acceptable evaluation for a batchless space stock,

But that was then and this is now. In the last one month, the shares of spontaneous machines have decreased by 14%, below $ 11 per share on Friday. For existing shareholders, this is disappointing. For investors wishing to buy in spontaneous machines for the first time, however, this may be an opportunity.

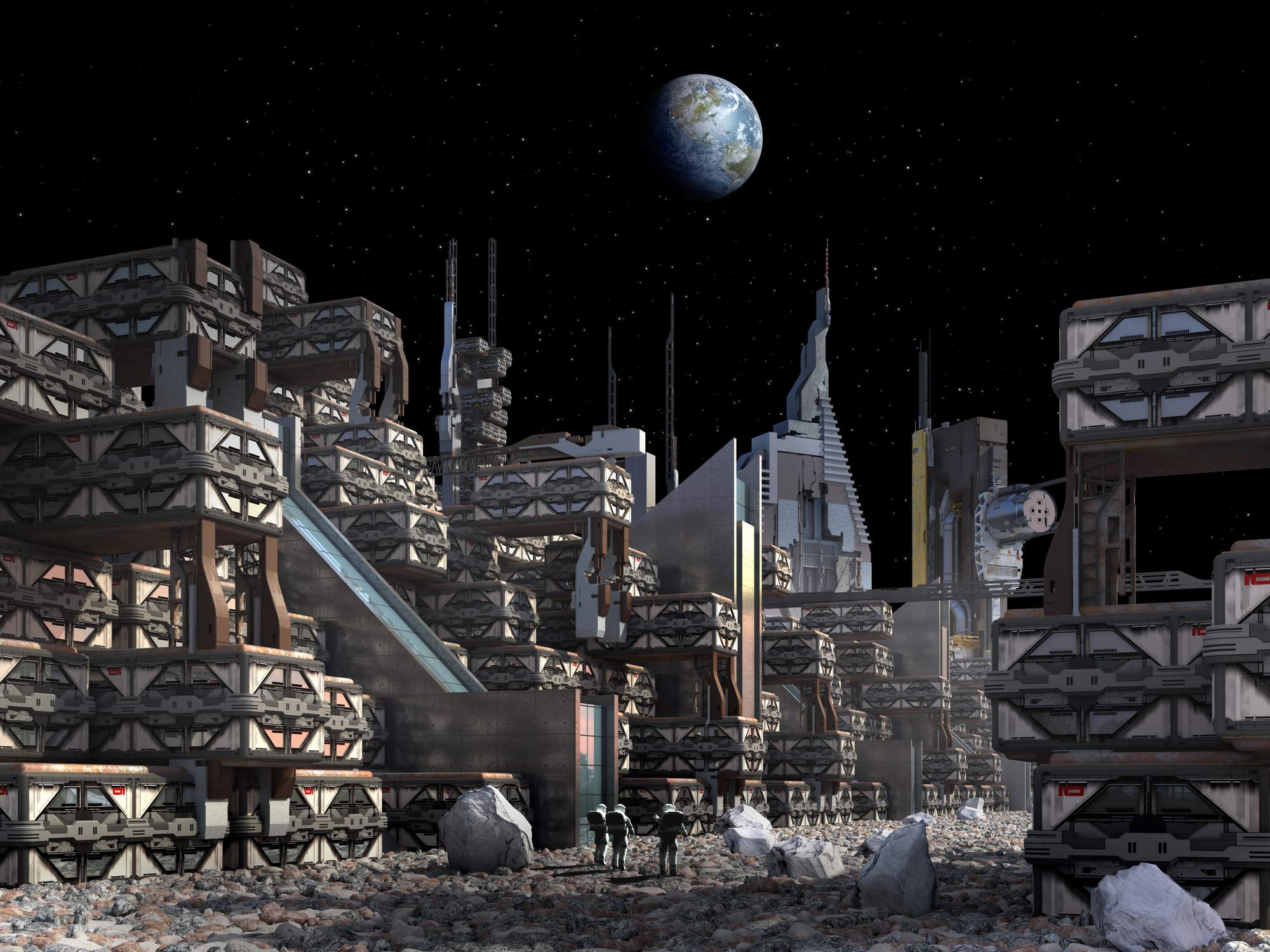

Image Source: Getty Image.

Introduction to machines with intuitive knowledge

If you are unfamiliar with the company, then there is a lot of definition of spontaneous machines one Space stockThe company is known to be the first private company to land a spacecraft on the moon, and to land American Spacecraft on Moon For the first time after the Apollo era 50 years ago.

It has actually landed in a spacecraft on the moon twice now. Given, neither landing was 100% successful – both vehicles were topped on their sides after landing – but they touched safe and intact before keeling. The company has secured NASA contracts for two more landing efforts to be held in 2026 and 2027. And spontaneous machines have promised to include “learned … lessons” to improve their performance on the next two from the first two partially successful landing.

As Filing with Securities and Exchange Commission (Sec)The company was paid $ 132 million for its first landing and $ 122 million for the second (NASA and contributing to revenue with various commercial customers). The third mission of intuitive machines, IM-3, is priced at $ 87 million, but this number can be increased, and not yet included payments from commercial customers.

However, these moon landing are as valued as contracts, however, they are safely dwarfed by different types of contractual intuitive machines from NASA last year. For $ 4.8 billion, spread over 10 years (so $ 480 million per year – quadruple the value of a lander contract), is hired to build the company Close space network The satellites that will relay communication from the lower Earth’s orbit to the moon and the back.

How to accept stock of intelligence machines

Over the years, both stock markets and corporate mergers and acquisitions (M&AS) are evaluating space stocks in the range of 2 to 4 times the annual revenue of 2 to 4 times the annual revenue.

Spontaneous machines had raised $ 217 million in revenue last year, meaning that stock should spend less than $ 880 million today. And yet it is currently close to $ 1.3 billion; “Factoring in shares organized by non-control interest holders,” S&P Global market intelligence Data shows that the company’s inherent market capitalization can be as high as $ 2 billion. So is it to pay too much?

I don’t think

Why not? Well, just consider a future in which machines with intuitive knowledge continue to launch a moon lander per year for NASA and its private customers (say, $ 120 million in revenue), and conducts the space network (for another $ 480 million), and does it. Nothing elseImagine that it does not provide communication services to private customers with a payload on the moon, launch or explore more than once every year Any New trade opportunities in space.

It is still $ 600 million per year in revenue, and on one Revenue evaluation Of the 4, this means that the stock of spontaneous machines should be $ 2.4 billion – and assuming that the company does all this profitably. (The value-to-sell ratio of 2 to 4 applies only to the unprofitable space companies, remember.) Yet the analysts voted by S&P Global estimated that spontaneous machines will actually start reporting profits based on generally approved accounting principles (((Gap) Just two years from now, in 2027.

Even the most extreme estimate of the current assessment of stock today, $ 2 billion, means that the stock is probably already underwellude – and a purchase.

Rich smith There is a situation in spontaneous machines. The micle flower has a position and recommends S&P Global. Motley is near the flower Disclosure policy,