Artificial Intelligence (AI) remains a top investment subject in the market and does not show any signal of slowing down. While some investors may beware of AI trend, the reality is that companies are investing huge resources in this technology, and taking many advantage.

One of the largest areas where investors will continue to see amazing growth are in data centers. Data centers are proliferative across the country to give home to computing hardware used to process AI, and it is mainly in these buildouts that companies produce benefits from AI.

Three stocks that I like at this place Nvidia ,NVDA -0.42%,, Taiwan semiconductor manufacturing ,TSM -2.12%,And Digital realty trust ,DLR 0.69%,I believe that this trio is currently a no-brine buying purchase, and investors should first consider these shares if they want to invest in the AI sector.

Image Source: Getty Image.

All three companies are important for AI

Navidia Graphics processing units (GPU) From the beginning, the AI arms race was conducted. The GPU has an important ability to process many calculations in parallel, making them ideal for complex workloads such as AI. Additionally, they may be connected in groups to further increase this effect. Some companies have gone as connecting 100,000 GPUs, making a final computing machine focused on AI.

NVIDIA holds 90% market share in data centers and innovates to maintain its leadership status. This dominance is clarified in the results of NVidia, the revenue Q1 is growing 69% year -on -year and is expected to grow at a rate of 50% in the second quarter, although NVIDIA management is known for regular internal expectations.

Nvidia cannot make chips themselves, so it designs them and sends production to Taiwan semiconductor. This fabless design approach has become a leading technique with other people among many major technical companies, such as Apple And BroadcomAdopt the same mentality. All these are Taiwan semiconductor customers, with countless others.

The Taiwan semiconductor has grown to become the world’s top chip maker, thanks to its best-in-class yield and continuous innovation. Although its 3Nm (nanometer) chip node has been a large hit between its client base, it is scheduled to launch 2Nm node later this year and 1.6Nm node in 2026. Both these innovations will bring significant progress in power consumption, which can help reduce the energy demand of data centers.

Digital Realty Trust is a unique approach to AI. It is a Real Estate Investment Trust (REIT) focused on the construction of data centers and then renting them to various customers. It is also well deployed to capture the data center buildout trends on a large scale, as it has a land to build an additional 4,300 MW capacity at the top of 2,800 MW which is already built.

Digital realty hopes that the demand for data centers between 2025 and 2030 will increase by 350%, leading to a lover investment such as stock. In addition, it gives investors a beautiful 2.9% dividend yield, which makes it a welcome change from specific technical shares (although NVidia and Taiwan semiconductor also pay a small dividend).

This trio has a compelling investment case, but why are they making smart purchases now?

Stocks may not be cheap, but they are not expensive for market opportunities

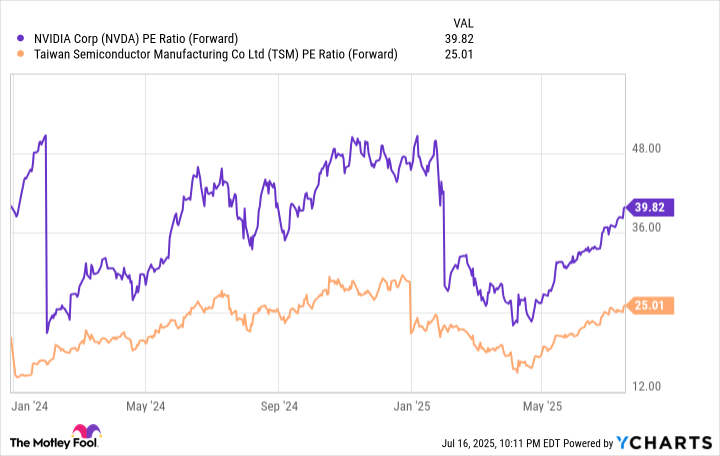

Both NVIDIA and Taiwan semiconductor have seen their shares recovering rapidly since coming down the market in April, which has greatly increased their evaluation.

NVDA PE Ratio (further) Data by Ycharts

However, both the stocks are still below the levels that they did trades in the second half of 2024, especially they were not expensive from a historic to a historic. Forward Price-to-Kamai (P/E) approach to ratio. An important warning with this assessment metric is that it only looks a year forward. Both shares are expected to experience a strong growth of many years, and if it proves to be true, it is even more reverse for these two.

Because digital realty is an REIT that increases significant depreciation costs, using a metric such as P/E ratio is a flawed approach. Instead, REIT investor is known as a metric Money from operation (FFO) To give importance to stock. Digital realty is expected to be $ 7.10 per share for 2025, which will give importance to the stock 24 times further on FFO. This is not the cheapest REIT, but is dealing with digital realty for market opportunities, I think it is a qualified price to pay.

These three stocks are excellent AI investment and Create for solid shares to buy now.

Keethane doe Broadcom, Digital Realty Trust, Nvidia and Taiwan are positions in semiconductor manufacturing. Motley flower has a recommendation of Apple, Digital Realty Trust, NVIDIA and Taiwan Semicondia Manufacturing. Micter flowers recommend Broadcom. Motley is near the flower Disclosure policy,