Unlock the editor’s digestion for free

FT editor Rula Khalf, selects his favorite stories in this weekly newspaper.

Good morning. Yesterday, Treasury Secretary Scott Besant and other US officials began another round of trade talks with their Chinese counterparts. There are semiconductors, rare earth and magnets on the table. Originally unhealthy suspected that the Trump administration would negotiate with China – we were wrong. But whether the conversation will be fruitful, there is another question. email us: unhedged@ft.com,

Metaplanet and bitcoin

Why would you buy a bitcoin company instead of buying bitcoin only? Some people, including some people, will not buy this newspaper, either. But let’s assume that buying bitcoin is a good idea. Why do this through a corporate cover?

A clear (if unsatisfactory and light spherical) is the answer that some companies that buy bitcoins buying bitcoins. Here is a chart compared to the performance of bitcoin, a leveraged bitcoin ETF, gamestop (which announced that it will start buying bitcoin in this spring) and strategy, the largest corporate bitcoin buyer:

Strategy (East Microstrate, when it was a software business) dominates here. But this is not the most amazing example of this phenomenon. This honor goes to Metaplanet, a Japanese Hotel Developer Announced On Monday that it will increase about $ 5.4BN to buy bitcoin – a property that was buying it on a very small scale for one or a year:

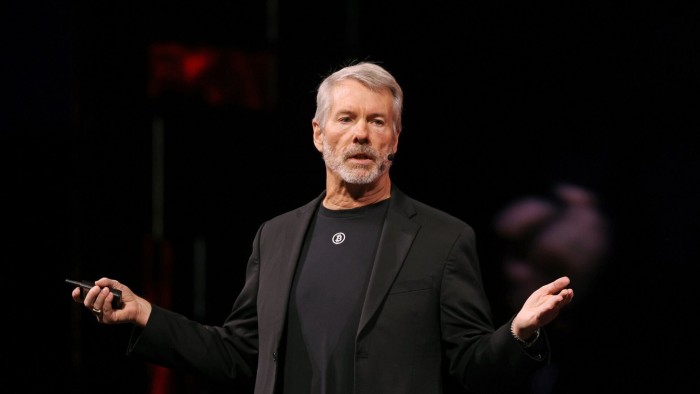

So where is the magic here? ETFs that track the price of gold. ETFs that track the price of bitcoin owners. Why should the company be better than bitcoin than bitcoin? The strategy provides type of interpretation. It currently trades 70 percent premium for its net asset value, which remains much more than its bitcoin holdings. So when it sells equity and uses income to buy bitcoin, the transaction is immediately increment. The company can buy more than one dollar bitcoin by selling a dollar equity. Here is the executive chairman of the strategy speaking in April, Michael Sirer:

How do we produce benefits? How do we generate shareholder value? So if we used to sell $ 100mn [our] Equity on more than one from the net asset value of two, then usually, what happens we capture. , , Half of that. The spread is 50 percent. We capture his $ 50mn as profit. This is an accreative component for existing common share shareholders.

ASTUEE readers must have seen that it is not an explanation of why the strategy trades the NAV on the premium. This is an explanation what the strategy can do Because It trades on a premium for NAV. So the premium still needs to be explained. Saylor argues that the premium part is present because the stock is very unstable and very liquid, which makes the shareholders attractive for the shareholders who can sell market call options against it and generate a high yield. Now, most companies do not think of extraordinary instability as a property, but Saylor thinks the instability of strategy is special:

You may find massive instability for a good reason or a bad reason. But management team [in a high-volatility company] There is generally no reliability and durability. How are you going to keep it for a decade? And so you see what we have done, we have created an instability engine. When you take instability. , , If you are smart, you make it a reactor and it becomes a power plant.

Readers can evaluate this approach to corporate finance. But I will pay attention that the financial strategies selling instability do not work until they do.

Another permanent source of premium valuation of bitcoin-holding companies is that they are a particularly easy way to achieve bitcoin exposure. In the UK, for example, obtaining bitcoin exposure may be very rare. By buying bitcoin, you leave it with the problem of storing it. Bitcoin -related exchange -traded notes were banned only Just liftedThe purchase of US bitcoin ETF shares for both retail and institutional investors, including annoying in paperwork. Strategy shares are easy to buy. And a similar pattern can hold up to more or less degrees, in various other courts.

Indeed, Metaplanet Board member David Bailey recently told my colleague Philip Stafford that “Michael Sirer lifted something with an insight: If you want to sell someone, you have to meet the buyer where they are.” He moved forward: “Liquidity is at the global, but it is stuck. We are packaging bitcoins in various forms, where they are, where they are.”

If this is correct, there is an irony here. If bitcoin-owned companies are eventually selling bitcoin liquidity, their companies will only add values until the bitcoin market remains disabled and cumbersome. If bitcoin, as promised us, becomes a universal and practical option for Fiat currency, or even a free trading store, companies’ premiums should disappear NAV.

China and American solar

We recently Wrote about the approach to American solar companies under the Trump administration. China, however, is the world center for the solar industry – especially in solar panel production. And China’s domestic solar market is very large; Two months ago, China’s solar and wind power capacity left back According to the country’s energy regulator, fossil fuel for the first time.

But this does not mean that Chinese solar panel producers are good investment. In the last six months, the first solar – the largest western solar panel manufacturer – has improved many of its Chinese contestants:

The Chinese solar market is cruelly competitive. Solar panels are now essentially commodities. Margine is thin and unstable. Recently, major Chinese manufacturers have struggled. Jinkosolar posted a loss in his first quarter; Tina Solar reported a major loss to all of FY 2024. The first solar earnings in the last quarter were not particularly strong, but it earned money.

Cheng Wang explains in Morningstar:

While Global Oversupply has made many solar markets unprofitable, the US market remains extremely profitable due to trade barriers that restrict the supply. Since most American solar firms are domestically concentrated, they produce healthy benefits. This assessment can explain the difference.

Joe Osa of Gugneheim noted that there was solar import control in the US for a while. “Price deviation [between the US and elsewhere] Is dramatic; In America [panels cost] What they spend in other markets more than twice. According to OSHA, the possibility of even more tariffs on China actually presents an opportunity for solar and other American producers.

Solar equipment tariffs are controversial. When having a domestic solar panel industry, they can understand that a legitimate national security is a priority, or if the Chinese government is engaged in hunter dumping. But the price paid by Americans is more expensive solar energy. Whether it can be worth it by having tariff in place. Domestic solar producers took advantage of any way.

,Repeat,

Read a good

Ft unhealthy podcast

Can’t get enough for unwanted? Pay attention Our new podcastTo make 15 minutes of dives into the latest market news and financial headlines twice a week. Hold on previous versions of the newspaper Here,