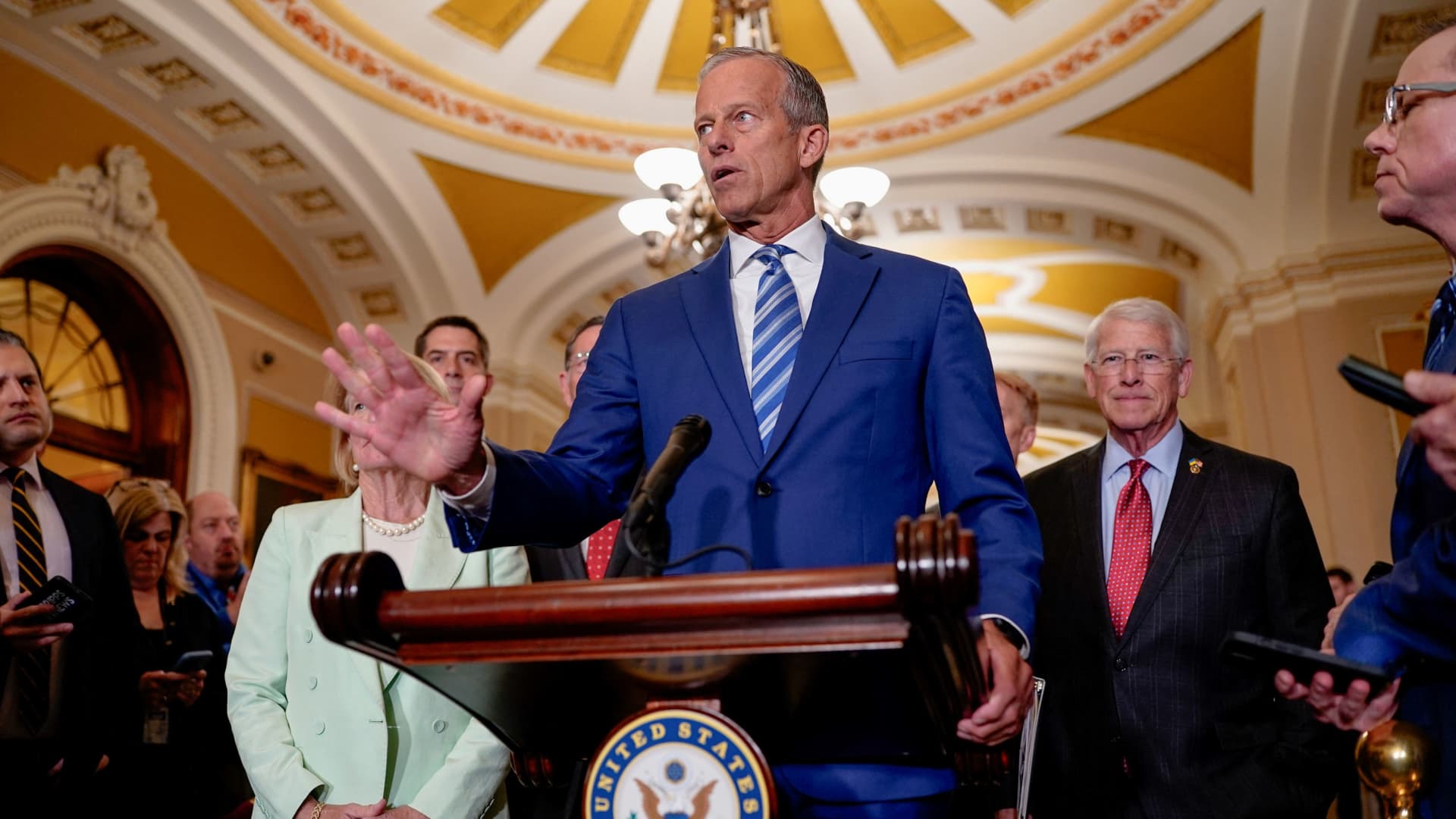

The US Senate leader John Theun (R-SD) speaks at a press conference after the US Senate Republican’s weekly policy lunch on Washington, DC, US, Capital Hill on Capital Hill in 10 June, 2025.

Kent Nishimura | Roots

After weeks “more than the nuances of one Big, beautiful bill, Donald Trump’s Desk before 4 July.

Questions remain on whether the House will eventually accept the Senate version BillWhich was finalized just before the midnight of Friday, as the 11th hour changes won-and for some disadvantages, businesses and special interest groups. The changes underlined the back and forth the jockey, which went to end the 940-hit bill.

A major sticking point for fiscal huxe is proposed by megabil $ 5 trillion loan roof Increase, a figure continues to emphasize some Senate Republican, questioning the leader of the Senate majority John Theun The ability to align your room.

Thyun has said that he wants to bring the bill to the floor for a major procedural vote according to Saturday afternoon. Accepting That he cannot have votes. Uncertainty speaks of the reality of the Razor-Razor-Majority of the Republican.

Here are some of the major elements of the Senate’s “big, beautiful bills”, and stands to benefit from them:

Promises for Trump’s campaign

If enacted, the Senate Bill will codes many campaign promises of Trump, including extensions for them. 2017 tax deductionLike low Income tax bracketHigh standard cut, a big child tax credit And other provisions.

The Senate Bill also includes new policy proposals, such as for tax break Tip incomeovertime pay, auto loan And one Bonus cut for old Americans To help compensate for social security income taxes.

In particular, many new tax brakes grow temporarily from 2025 to 2028, which can affect taxpayers as 2026 filing season.

An earlier Senate Draft must have reduced domestic taxes on average About $ 2,600 in 2026According to the tax policy center, the house is slightly less than the bill. However, the organization found that the benefits from both versions would slant the upper -income families.

‘Ravenging Tax’

Republican and Treasury Department agreed to scrap the so -called this week Average Provision – Formally known as Section 899 – the Wall Street brings a sigh of relief to investors, which was afraid that it could make the US a less attractive place for investment.

The purpose of the tax is to take a vengeance against any country, whose taxes were considered “discriminatory” or inappropriate against America

Treasure Secretary Scott Besant Said He would roll a joint understanding between “a joint understanding among the G7 countries, which defends American interests, as he asked the Congress to remove the provision from the tax bill.

Law firm Holland and Night’s lawyers said in a tax note, “Great concern was expressed by Wall Street and the impact on Foreign Investment in Section 899 and its impact on foreign investment in the United States, especially its complexity, its complexity, application and its impact of its potential scope of compliance, were influenced by its impact.” CNN report,

‘Salt’ cut

The Senate text also includes a temporary deal with the House Republican on the border Federal cuts for state and local taxesIs known as salt. Passed through Trump’s 2017 tax deduction, $ 10,000 cap has been a sticky point for some MPs in blue states.

The Senate Republican will increase the CAP to $ 40,000 in 2025, which will be with a stepout starting after an income of $ 500,000. Both figures will increase by 1% each year through 2029 and the cap will return to $ 10,000 in 2030.

However, in a win for industry groups, the law will leave one Salt cap workaround For pass-through businesses, which allow owners to bypass $ 10,000 cap. In contrast, the bill approved by the house would have ended the strategy for some white collar professionals.

“This is a fruitless approach to tax policy,” Center, Executive Director of Tax Law Center in the law of New York University, Chai-Ching Huang. Said in a tweet On Saturday.

He said, “This preserves a range (and reduces) on cuts for rich taxpayers, ignoring a flaws that allows those taxpayers to completely avoid the border,” he said.

Medicaid

There is a point of dispute in the package Medicade proposed deep cutsInsurance programs for low income and disabled Americans that provide coverage for more than 70 million people.

The Senate MP made some medicade cut later this week, but also kept others Work requirements According to 80 hours a month, which can endanger the ability of millions of Americans to obtain health insurance, Congressional Budget Office,

Targeted carvings

Some MPs and industry groups registered a final-win victory, underlining their state components, underlining the conversation that probably until the bitter end to the suspicious Republican occurred.

For example, a provision in the bill will increase the deduction for whale-shikar-related expenses from $ 10,000 to $ 50,000, which will provide a win for the Alaska Republican sensor. Lisa Murkowski and Dan Sulivan, Politico reports,

And, in a significant shock for renewable energy advocates, car manufacturers and some consumers, the Senate bill will eliminate $ 7,500 tax credit on electric vehicles and leases.