key points

Most of the beneficiaries of social security are happy to collect their monthly checks, but the program is not providing income the needs of a specific retired. The average payment is currently a minor of $ 1,976 per month, so a retired requires its savings to cover the rest of their ongoing expenses.

The question is how? How should someone’s retirement savings be transformed into reliable passive income? Interest-bearing bonds are a clear choice, but for many people, dividend-paying stocks are a minimum important part of the mixture.

Now to invest $ 1,000? Our analyst team only revealed what they believe 10 best stock To buy now. learn more “

enter the Schwab us dividers equity ETF (Nysemkt: schd)A compelling investment that is looking at anyone to complement their monthly Social security benefits Want to consider

Here you should know what you should know about this exchange-traded funds.

What about Schwab US Dividend Equity ETF?

First, the dividend yield of the follower of ETF -12 -Mane is average of less than just 4%. S&P 500 Index funds and many other dividend-focused funds. The status of $ 100,000 will currently tell you about a dividend of $ 4,000 per year.

However, this index is also attractive due to track. Inherent Dow Jones US Dividend 100 Index Screen for 100 high quality dividend shares (except reits) with the basic requirement of 10 consecutive years of payment. Index components also have the highest overall scores based on equity, dividend yield, five -year dividend growth rate, and their withdrawal free cash flow relative to the total debt.

Image Source: Getty Image.

Its top holdings are included Texas instruments, Shehtir, Conocophilips, MerkAnd PepsiCoJust to name a few. In addition to high dividend yield, ETF can also be seen as a price game because its average price-to-earning ratio is only 16 times. It’s well down S&P 500Following P/E ratio of 25.

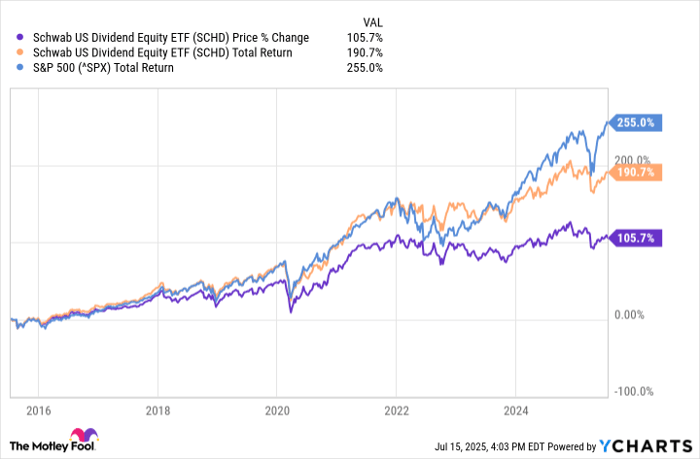

Although strict screening criteria contribute to high yield and increasing payment of ETFs, the fund has reduced S&P 500 in the last decade.

Data by Ycharts,

This difference has widened since the beginning of 2024 as market trends recently – that is, rise artificial intelligence (AI) – Disfact ETF holdings.

So what about retired people considering the share in SCD?

Although it is true that Schwab US Dividend Equity ETF does not keep high-development AI shares that are transporting the wider market to new heights, the S&P 500 has a inflated evaluation for many of the largest stocks and an indefinite economic background already has many market followers playing alarm bells.

Keeping this in mind, the stable dividend payment and Price stock In this Schwab ETF, one can appeal to the people especially retired to complement their social security income. As Morningstar “Not only the price shares have been evaluated on an absolute basis, but they also have some of the highest underwellood levels relative to the wider market in the last 15 years,” analyst David Seerra said in the 2025 market point of view in the recently published third quarter published the company’s recently published third quarter. He creates a point of connecting, “In a market that is overwallized, we see the value in the relatively high dividend yields found in the price category.”

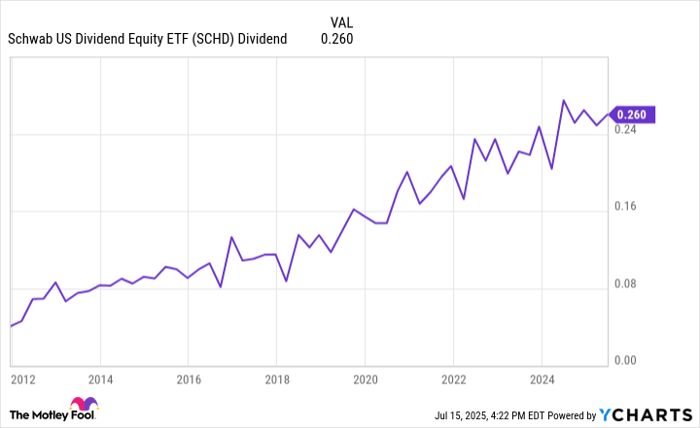

And beyond the high yield of the fund, its payment has also increased over time as you can see below.

Data by Ycharts,

Ground level? While the Schwab US Dividend Equity ETF can currently lag the S&P500 by a widespread difference than normal, people who invest in funds can rely on that they can provide their portfolio to provide stable income by highlighting their portfolio to the wider market than the wider market. They are particularly valuable symptoms that retired people should appeal in the hope of promoting their income.

$ 23,760 Social Security Bonus Most retired completely ignore

If you are like most Americans, then you are behind your retirement savings a few years (or more). But a handful of small “Social Security Secrets” Your retirement can help ensure an increase in income.

An easy trick can pay you more as $ 23,760… every year! Once you learn how to maximize your social security benefits, we feel that you can retire with confidence that peace of mind, after which we are after all. Add Stock advisor To learn more about these strategies.

See “Social Security Secrets” »

James bumli There is no situation in any shares mentioned. The micle flower has a position of Chevron, Merc and Texas Instruments. Motley is near the flower Disclosure policy,

The idea and opinion expressed here are the idea and opinion of the author and not necessarily Nasdac, Inc.