Stock splights were a big thing last year, in which many major companies in industries were starting such operations. Two of the most exciting were in the field of Artificial Intelligence (AI). Nvidia ,NVDA -0.42%,World’s number 1 AI chip designer, and Broadcom ,Evgo -1.12%,A networking giant, completed stock splights in June and July 2024 respectively.

What is stock split, and why do companies go on this route? These operations enable a company to bring down the stock price that enhances a more appropriate level, making the stock more accessible to a broader category of investors. Nvidia and Broadcom even said that they decided on partition for employees and investors to make their shares easier, which had increased in 2023, 200% and over 100% respectively.

The stock division does not change the total market value or anything fundamental, though. They simply offer more shares to current holders according to the ratio of division. Therefore, for example, in 10-for-1 stock split, if you originally hold a share, you will catch the post-split of 10 shares-but the total value of your holding will remain the same.

Because of this, a stock split is not the reason for buying or selling stocks alone. Nevertheless, it is interesting to see how the stock split players have performed after these tasks, so let’s take a look at both Nvidia and Broadcom a year after their partition.

Image Source: Getty Image.

Nvidia

NVIDIA completed its 10 -for -1 Stock split On 7 June last year, with trading of shares at Split-Adjustable Price till 10 June. It brought shares below $ 1,200 to $ 120. Since that time, Nvidia stock has experienced ups and downs, but it provides a profit of more than 40%.

As mentioned, it is not an operation that investors have rotated in NVIDIA in the last one year (although low price per share has made it easier to achieve development story for some). NVIDIA’s share price performance is operated which is the ongoing high demand for it Graphics processing units (GPU)Or AI chips, and related products and services.

The AI leader also helped that it was a strong performance of a large launch: Nvidia released his Blackwell Architecture and demanded a chip in this last winter that CEO Jensen Huang called “crazy”. The company generated a revenue of $ 11 billion from Blackwell in the first quarter of its commercialization and maintained a gross margin above 70%, ensuring high profitability on sale.

Although investors are concerned about potential headwinds, such as import tariffs or decreased spending, these concerns have reduced these concerns. Business talks have inspired optimism that tariffs may not initially be heavy as expected, and companies have repeated their AI investment plans. All of this helped promote NVidia shares in recent weeks, even pushed the company $ 4 trillion market capIt is making it the first company to reach this level.

Broadcom

Broadcom executed his stock split on 12 July, and the Stock started trading at a new price on 15 July. Like Nvidia, the company decided on 10-for-1 split to reduce the price of its share-in this case, from $ 1,700 to $ 170. Broadcom stock has also climbed into double digits since the operation, increasing more than 65%.

And like Nvidia, Broadcom thanked his shares for the demand of AI customers. The company is a networking leader, from your smartphone to major data centers – uses thousands of products used in different places. But in recent times, the demand of large cloud service providers to support its AI development has helped the sky touch the sky.

In the most recent quarter, the AI revenue rose by 77% to $ 4.1 billion, and the company says that this speed will continue in the current quarter and through the next financial year. It is between connectivity products and the demand for Broadcom’s quick processing units (Exume), which is a type of processor for specific AI functions.

The company says its networking expertise and wide range of products – from switch and router to network interface card (NIC), which connect the computer to the network – have been the leading growth drivers because cloud service provider ramps their AI platforms.

Broadcom Stock followed a similar route to Nvidia, declining in April this year due to general tariff concerns, but it has also overturned and growing today. The stock also closed at a record high level a few days ago.

Can the post-skill success continue?

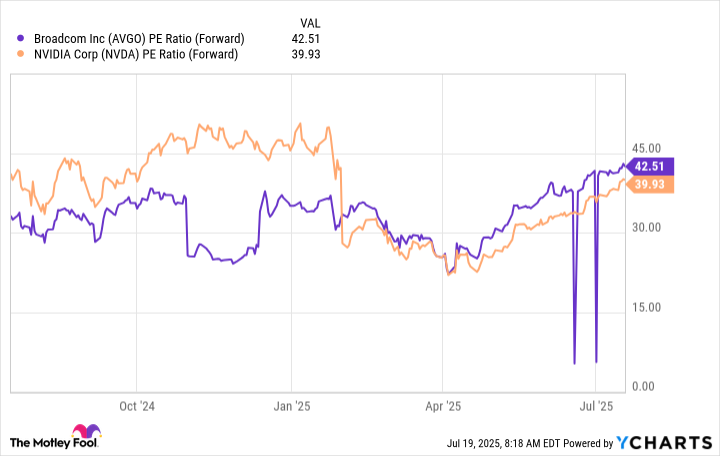

Both Nvidia and Broadcom have completed successful post-split years, which scores profit in double digits. A little less expensive than Nvidia An assessment approach It was a year ago, but the evaluation of Broadcom has become advanced.

Evgo PE Ratio (Further) Data by YchartsPE ratio = price-to-Kamai ratio.

Nevertheless, these AI players have a reasonable price, given their earnings track records and long -term possibilities in this development market. This is impossible, of course, to guarantee what these shares will do next, but the current environment further supports the idea of more profit. Even more importantly, Nvidia and Broadcom are well deployed to win in the AI market for a long time.