Brazil is hoping to sell its first sovereign loan in the Chinese market as soon as this year, as President Luiz Eneasio Lula da Silva appears to strengthen trade and investment relations with the Asian superpower.

The leftist administration in Brasilia plans the so-called panda bond-a loan issued by a foreign borrower in the Chinese Renminbi-and is eager to re-enter the euro-sect. bond marketAccording to Deputy Finance Minister Dario Durigan.

He told Financial Times in an interview, “This year we will release a new dollar of a permanent bond, just as we did last year, as well as in Europe and Panda Bonds in China,” he told the financial Times in an interview.

Durigan said, “The European Union wants to interact with Brazil to expand our bilateral trade, whether it is in terms of transactions or offering Brazil to release their bonds in Europe,” Durigan said. “The same thing can happen to China.”

The Lula government is trying to deepen commercial relations with Brussels and consolidate the link with Beijing, amidst the global trade war carried out by US President Donald Trump’s widespread tariff.

The Mercosur block of the South American nations, of which Brazil is a member, hopes that a long -awaited trade deal with the European Union will be approved by the end of this year. On Thursday, Lula met French President Emmanuel Macron and appealed to support the agreement during a state visit to Paris. Macron has so far opposed the perception of the trade treaty, which has been strongly opposed by the French farmers.

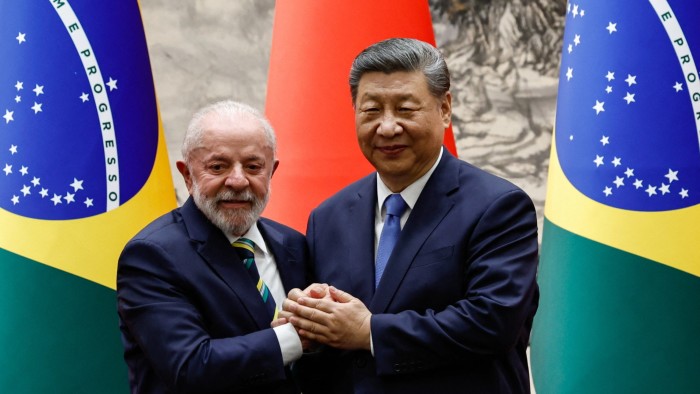

During a state visit to Lula last month, China, Brazil’s largest trading partner has plans for a pandy bonds amidst efforts to secure more investment. Beijing has also put an attraction towards Latin America as it looks to broaden its economic impact.

“In many cases I used to think [panda bonds] As a diplomatic step instead of a financial one, “Graham Stock said,” Emerging markets in RBC Blue Asset Management, sovereign strategists, such tools are usually from just $ 200mn to $ 300mn size. “

The release of employed will test the international investor hunger for Brazil’s debt at the time of growing market doubt to Lula’s policies, seeking to increase the state’s role in the economy in an attempt to promote growth and reduce inequality.

His government’s tax-and-cost approach has harassed Brazilian business leaders, arguing that excessive spending is promoting inflation, forcing interest rates and putting unstable government debt at risk.

Alberto Ramos, an economist from Latin America, the main Latin America’s chief of Goldman Sachs, said, “In the day, they are thinking of new ways to spend money.” “They still need to adjust the budget deficit by three percent marks of GDP to make the finance sustainable.”

Brazil mainly gives itself a funding through domestic investors, with less than 5 percent of public loans engaged in other currencies – mostly dollars. Its last euro was released.

This week, Brazil gave a yield of 5.68 percent in a yield of $ 1.5 billion of a bond of five years and 6.73 percent in a 1.25BN yield of a 10 -year loan. This was to release the second international of the country of 2025.

Stock of RBC Bluee stated that releasing in Rainaminbi would be cheaper than Reais, possibly 2 percent lower for a 10 -year loan, but currency leaves the risk. He said that the dollar hedging could push the rate of close to the cost of borrowing in the US currency, while the hedging in the resis increased it by about 14 percent.

The cost of lending in Brazil has increased as the country’s central bank has increased its benchmark rate by 14.75 percent in an attempt to subdue inflation. Opponents accused the government of not enough to deal with an old fiscal deficit and rising debt level.

Durigan stated that the administration was on track to meet its 2025 target of a balanced primary budget, meaning before the interest payment. The government is targeting the primary surplus of 0.25 percent of GDP for next year. However, the country’s nominal public deficit, including interest payments, has increased by 7.8 percent of GDP under Lula.

Nevertheless, Durigan hopes that the country is moving towards investment grade status.

“We are making a progressive fiscal adjustment. In other words, we are balanced with social justice,” he said.

“Our public debt problem comes from interest today,” he said. “If we start addressing the fiscal situation, we allow the central bank to gradually provide the interest rates with conditions, we will be able to get an investment grade [rating next year],

However, Goldman K Ramos was suspicious. “They will not get investment grade next year,” he said. “They are not even close.”

Moody’s upgraded Brazil’s long -term rating was at a notch below the prestigious position in the previous October, which opens the door to the cheap capital. However, the rating agency amended to stabilize the country’s credit outlook from positive last month, which refers to a slow pace compared to the expected progress on fiscal policy.

Next year with a general election, suspects are afraid that the government will resort to high welfare payments and other GIVEAWAYS before the vote.

Last month, an announcement, which was designed to increase public finance by freezing $ 31BN (US $ 5.5BN) at expenditure, trigger market sales due to poorly transmitting some financial transactions. There is doubt about the government’s commitment to penance and some people were considered as a way of discouraging money from leaving the country, although Finance Minister Fernando Hadad denied any intentions to impose capital control.

Barclays economist Roberto Sekmsky described the country’s fiscal state as “very delicate”, given that the biggest debt load in the emerging markets, with gross government’s GDP at 76 percent of GDP with gross government borrowings.

“Brazil requires a primary surplus of at least 2 percent to stabilize the loan,” he said. “We are far away from it. A lot of adjustments are necessary that have been postponed and will be really dealt with only in the next administration.”