BBC Business Reporter

Getty images

Getty imagesOfficial figures show that chocolate prices in the UK increased at the fastest speed in May as the total cost of food continued to rise.

The main rate of inflation remained up to 3.4% in May in May, the highest for more than a year.

However, food prices increased to the third consecutive month, as some economists estimated that businesses were passed by customers from recent increase in employer national insurance payment.

Chancellor REWS had increased with a high minimal wage, with a high minimum wage, with a high minimum wage in April, after the announcement of increasing £ 25BN in the last October budget.

Food prices have increased by three consecutive months and at 4.4% in May, the highest since February last year.

Ruth Gregory, Deputy Chief Economist of Capital Economics, suggested that the growth “perhaps provides a temporary signal that the firms are passing more than the April increase in national insurance contribution to their sales prices”.

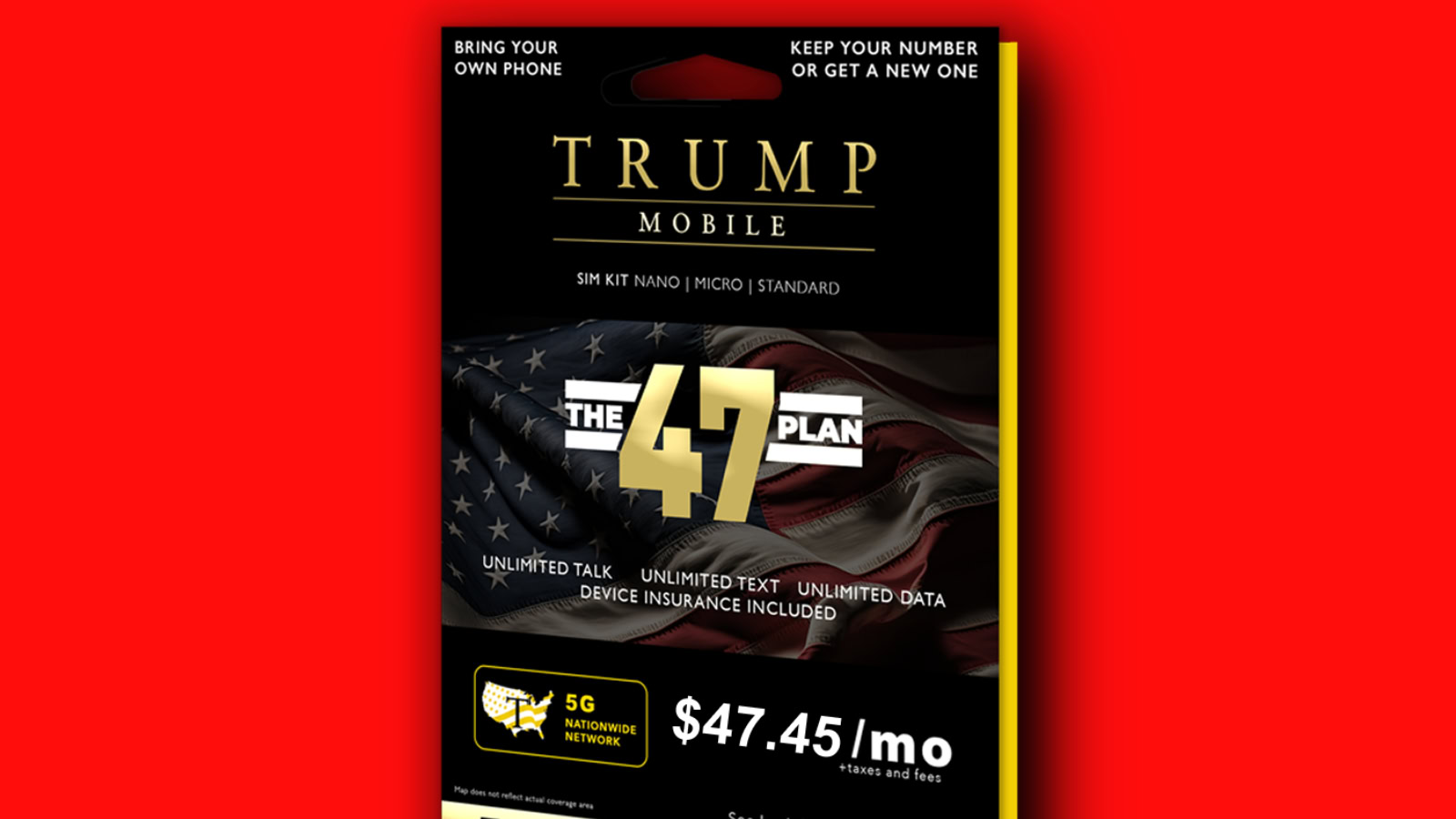

Chocolate is particularly affected by poor crops in cocoa-producing areas, as bad weather kills Ghana and Ivory Coast.

Chocolate stock fell into the first time climb in the year, leading to the price increase.

According to ONS, chocolate prices increased by 17.7%in the year from May. This is the fastest speed since 2016 when ONS records started.

In May, the rising food inflation from cheap travel prices was partially offset.

The office for National Statistics stated that the cost of the plane tickets last year with a large increase “Easter and school holiday time affected pricing as”.

The overall speed of the price in May was the same as April, after an amendment by the office of the National Statistics (ONS), and this means that inflation remains at its highest level for more than a year.

Inflation is above the target rate of 2% of the Bank of England, but is not expected to cut interest rates on Thursday.

Commenting on the rate of inflation, Chancellor Rachel Reves said: “This government is investing in the renewal of Britain to improve working people.”

But Shadow Chancellor Mail Streak called the latest inflation figures “deep concern for families”.

He said, “Labor’s choice for tax jobs and the choice of borrowing are preventing development and inflation – making everyday imperative more expensive,” he said.

Chris Hammer, director of Insight in the British Retail Consortium, who represents the region, said: “Since October, retail vendors have warned that the cost from the Chancellor’s budget may not be completely absorbed and will essentially lead high prices for shopkeepers.”

‘Youth families are now valued’

Getty images

Getty imagesZanya Omar, owner of the coffee stand Harbor Grind at Whitestable, told the BBC that the business is “good”, but has noticed that the budget of consumers has been squeezed.

Customers are not buying more food than that, when they travel a day of Kent Seized Town, they choose instead of bringing pack lunch.

“Most of the people are retired here, so their income is,” said Ms. Omar.

“But the young family, you notice with them that they will first investigate or compare prices with a strip, and then come back.”

Ms. Omar said that hidden costs – such as card machine fees, which have been sold around 10P additional coffee – offered them a small discount to cash customers.

For now, she will keep her prices as they are. “I will go out of business if I increase my prices,” he said.