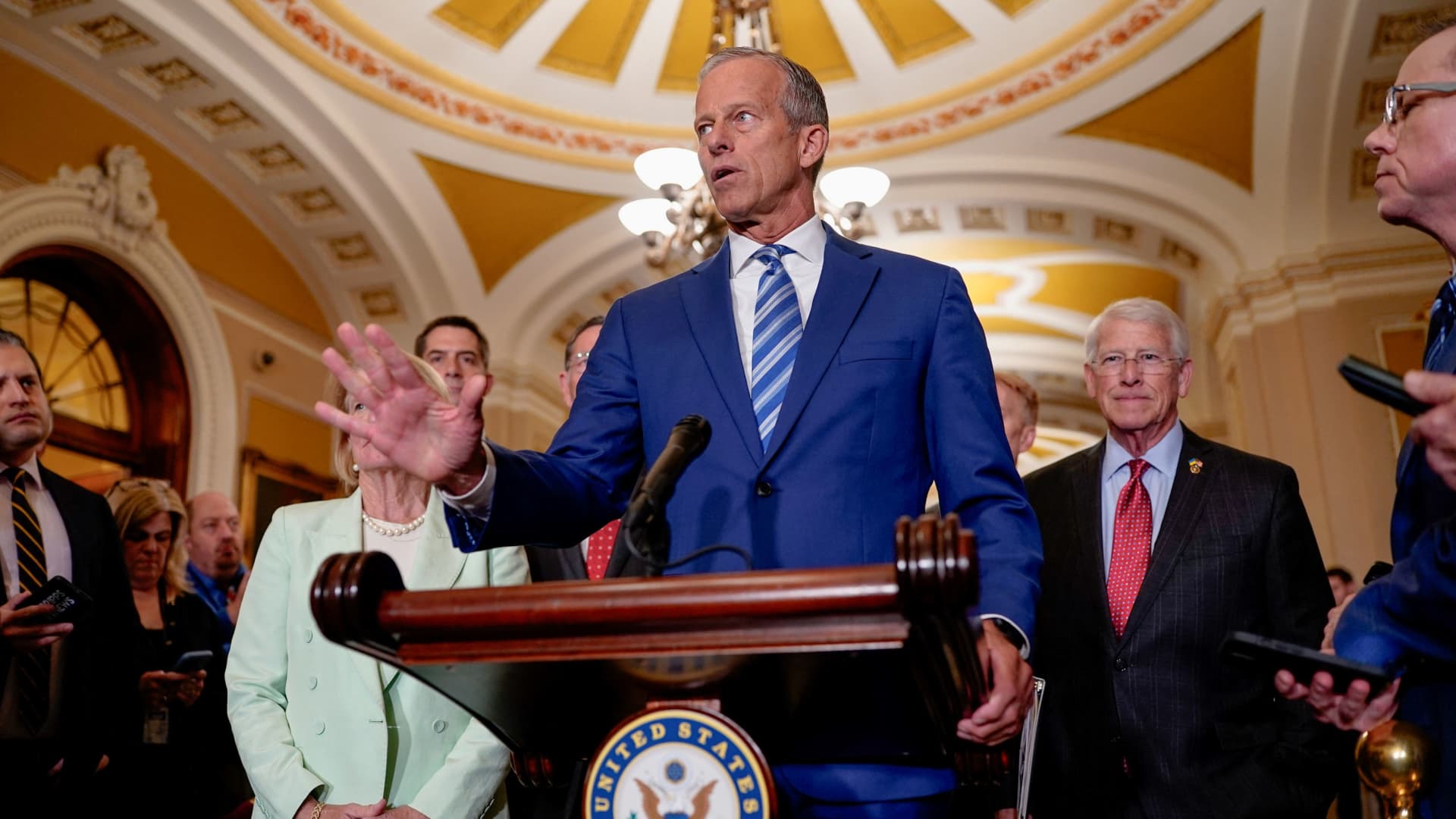

The US Senate leader John Theun (R-SD) speaks at a press conference after the US Senate Republican’s weekly policy lunch on Washington, DC, US, Capital Hill on Capital Hill in 10 June, 2025.

Kent Nishimura | Roots

As the Senate Republican release Main details President Donald TrumpExpenditure for package, including federal deduction for some provisions, State and local taxesKnown as salt, lives in Limbo.

Enacted through Tax deduction and jobs actOr TCJA, 2017, is currently one $ 10,000 limit On the cut of salt through 2025. Prior to 2018, the tax break – including the state and local income and property taxes – was unlimited to the filers who had cut. But so -called Alternative minimum tax Reduced profit for some high -grossers.

Senate Finance Committee Proposed text The $ 10,000 salt cut hat released on Monday is expected to be replaced during the Senate-House talks on the spent package. That limit is down $ 40,000 cap Approved by House Republican in May.

More than personal finance:

Fed is likely to keep rates stable this week. What does it mean to you

How to protect assets between immigration raids

IRS: Estimates of your second quarter by 16 June

Salt cuts have been ‘controversial’

“Salt has been controversial for eight years,” said Andrew Lutz, Associate Director of the Economic Policy Program of the bipartisan policy center.

Since 2017, the salt cut cap has been an important issue for some MPs in high tax states such as New York, New Jersey and California. Members of these houses have taken advantage of during a conversation between a slim house Republican majority.

Under the current law, the filers doing tax brake items cannot claim more than $ 10,000 for salt cuts, including Married couples jointly fileWhich is considered a “marriage punishment”.

However, increasing the salt cut cap has been controversial. If enacted, the benefit will be mainly Flow in high-oriented housesAccording to an analysis from the committee for a responsible federal budget.

Currently, the vast majority of the filers – Broadly 90%According to the latest IRS data – use standard cuts and do not benefit from items tax brakes.

In addition, the 2017 Salt Cap was enacted to help pay for other TCJA tax brakes, and some law manufacturers support the low limit for funding purposes.

There is no higher level of interest in doing anything in the Senate in the Senate, “John Theun, the leader of the Senate majority, said on June 15”Fox News Sunday,

“I think at the end of the day, we will find a landing spot, hopefully the votes we want in the house, a compromise position on the issue of salt,” he said.

But some house is republican already pushed back On the $ 10,000 salt cut cap included in the Senate draft.

Rape. Mike Lallor, RN.Y., On Monday, Senate described that Senate proposed a $ 10,000 salt cut range as “dead on arrival” X post,

Meanwhile, rape. Nicole Malliotcis, RN.Y., Posted about the post on Monday also $ 10,000 cap on XHe said that the lower limit was “not only humiliating, but a slap on the face of Republican districts that distributed our majority and trifacta.”