Although the technology sector is still heavy in the race of artificial intelligence (AI) weapons, the quantum computing race is starting to heat up. Quantum computing can unlock the next stage of AI, as well as innovations in other areas, such as logistics. However, the industry is still a few years away from watching quantum computing deployed on a large scale, and investors need to be careful not to include very quickly.

Nevertheless, I think there are some quantum computing stocks that are worth buying today and can work well for investors, even if the next few years of quantum computing development came out.

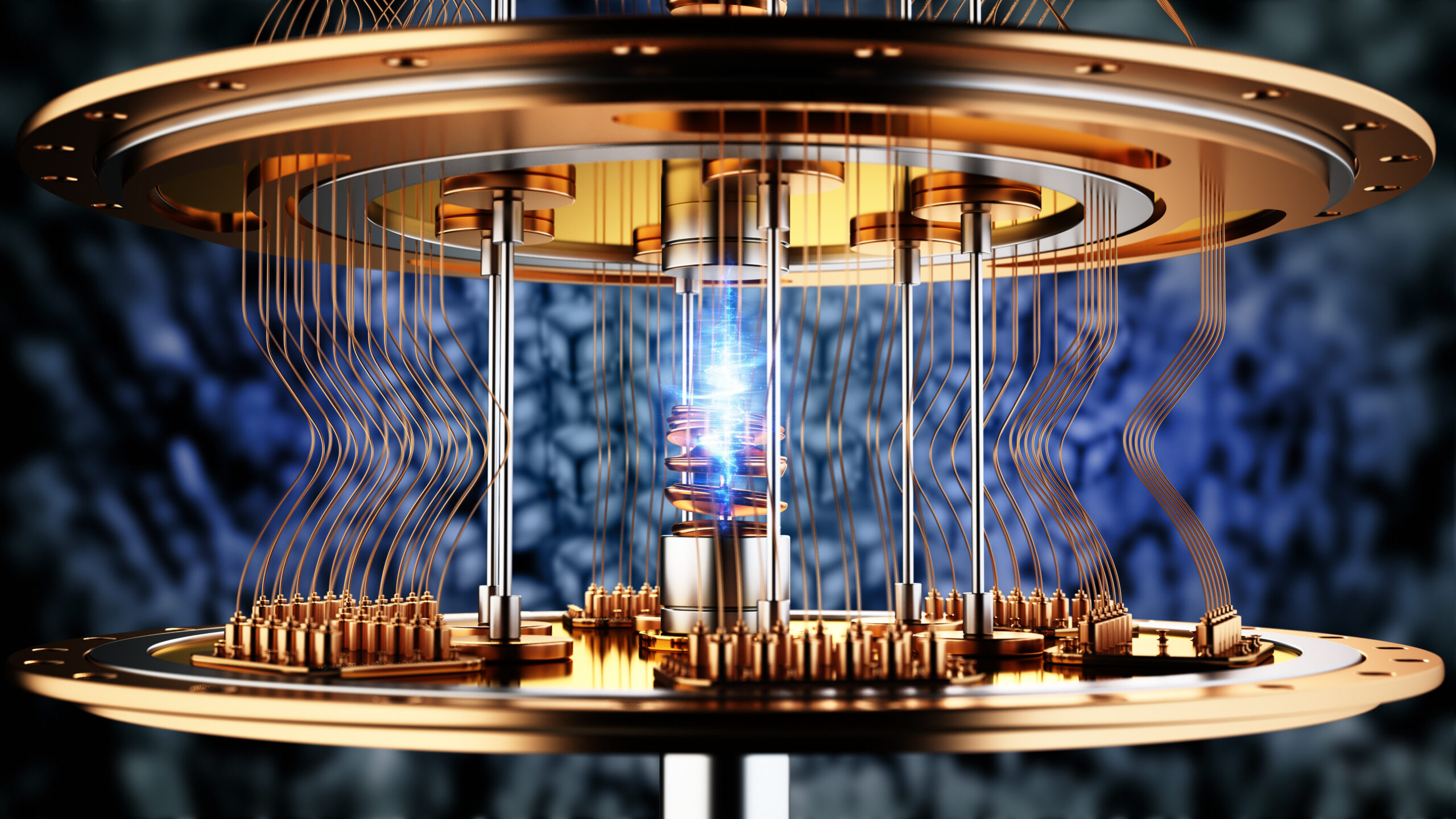

Image Source: Getty Image.

Nvidia

Nvidia ,NVDA 0.35%, There is probably not the first company that comes to mind thinking about quantum computing. Experts in it Graphics processing units (GPU)Which is designed to run using traditional computing techniques. However, Nvidia sees the capacity in quantum computing and wants to partner with more and more quantum computing companies to ensure that it is used in combination with its equipment. Quantum computer,

The GPU is a technology separating NVidia in the world its cuda software, which allows developers to maximize the computing capacity of GPU. NVIDIA has begun to develop CUDA-Q software, which will integrate with various quantum processing units being developed by other companies. This software integration will bridge the gap between traditional and quantum computing, ensuring that Nvidia, regardless of its success, will capture a slices of the quantum market.

Meanwhile, investors continue to receive the benefits of NVIDIA’s GPU sales, giving fuel to the AI weapons. There is still a ton more computing ability that needs to be made, and the stock of Nvidia will continue to capitalize on it for the coming years.

Alphabet

Alphabet ,Good -0.43%, ,Gogal -1.19%, In December, quantum computing investment propagated when it announced his Willow Quantum Computing Chip. Willow solved a problem in five minutes, with the fastest supercomputer 10 septilians (10 to 25th power) to complete years. The test was stacked in favor of the willow, as it included a problem that takes advantage of the strength of quantum computing, but shows that accurate quantum computing technology is possible.

Similar to Nvidia, the alphabet does not require its quantum computing investment to be a successful investment. It has an incredibly successful base business and is also developing the top-oriented AI device that will allow the alphabet to excel in the AI-first world. In addition, the stock of the alphabet is currently underwelled 18 times ahead,

Gogal PE ratio (further) Data by Ycharts

While most quantum computing and AI stocks are quite expensive, the alphabet’s stock provides solid value to investors. The alphabet is a heavyweight contestant in both AI and quantum computing race, with it an excellent purchase right now.

Ion

Ion ,Ion 6.92%, A pure-play is quantum computing investment, and it is my top pick between companies whose commercial models are completely based on the success of its quantum computing products. There is no backup plan for ionic; If it fails, the stock price will fall to $ 0. This is an important idea for investors, and the size of the situation must be suitable for a company that carries a higher risk as a ionic.

However, there are many positive signs with IONQ stock. It holds several major quantum computing contracts, including the US Air Force Research Laboratory. The company also consists of a leading two-quit gate fidelity, which is a common measure of the accuracy of quantum computing calculations. This stems from all-of-all connectivity of IONQ, which allows each QBIT to interact with each other to make it possible to calculate the most accurate calculation.

In addition, Ionq has developed a practical approach to quantum computing, as its stuck ion approach enables the computer to operate at room temperature. Most other solutions are focused on the superconducting path, which requires the particle to cool at almost full zero temperatures. Whether the technology of IONQ should give concrete results to future customers, it can completely differ from competition based on its operating costs.

Ionq is still a long shot, but I think it is best among pure-play start-ups. An investment portfolio is a concrete approach to pair ion with alphabet and Nvidia, as it allows investors to balance all-or-any investment risk with companies with companies. Which are established solid businesses like Nvidia And alphabet.

Suzanne Frey, an executive in Alphabet, is a member of the Board of Directors of the Motley Flower. Keethane doe There is a situation in alphabet and Nvidia. The micle flower has a position and recommends the alphabet and nvidia. Motley is near the flower Disclosure policy,