Rivian motor vehicle ,to harass -3.34%, There is a very promising future. In early 2026, management is expected to start production of three new affordable electric vehicles (EVS). Creating cheap EV under $ 50,000 is a large milestone for an automaker. When? Tesla Released its affordable model Y and Model 3 vehicles, sales bounce. Today, more than 90% of Teslas have auto sales in those two vehicles.

However, some recent news may be a huge shock for the development plans of the rivians. The new bill of President Donald Trump proposes to cut the federal EV tax credit, which will make electric vehicles more than $ 4,000 to $ 7,500 expensive for buyers. How much will the rivian suffer? The answer might surprise you.

Revians may risk reaching their next development catalyst

Many investors are watching Electrical car stock Next to find Tesla. This is a worthy mission. Tesla’s shares have increased by 23,000% since 2010. What is the key to spotting the next Tesla? Look for companies that can launch cheap models of less than $ 50,000. As mentioned, reaching this milestone makes a huge growth catalyst, making the automakers model cheaper to millions of new buyers.

Right now, the rivian is correct on the track. After releasing two luxury models with a premium price tag – Tesla is preparing to introduce the production of three new affordable models: R2, R3 and R3X. The production is slapped to start in 2026, but I am not expecting complete production of all three models by 2027 or 2028. Nevertheless, there is no doubt that the rivian is ready to hit its biggest development milestone in years. With $ 4.7 billion cash on books, as well as a deal Voxwagen It can distribute many more billion dollars in the capital, the Revians feel that it is a means to bring these vehicles to the market. This will allow sales to grow, and the profit is likely to improve the margin, and will also provide more operational lests.

Even though the EV tax credit has been abolished, the rivian has capital to reach this development catalyst, which means an increase in sales should be expected that whatever future brings. Currently, the price of rivian vehicles is between $ 70,000 and $ 100,000 depending on the exact package. If the company can pay the price of three new vehicles under a mark of $ 50,000, it makes its lineup much more cheaper even without tax incentive. In fact, EV tax credit may end up to terminate Help Rivian long -term.

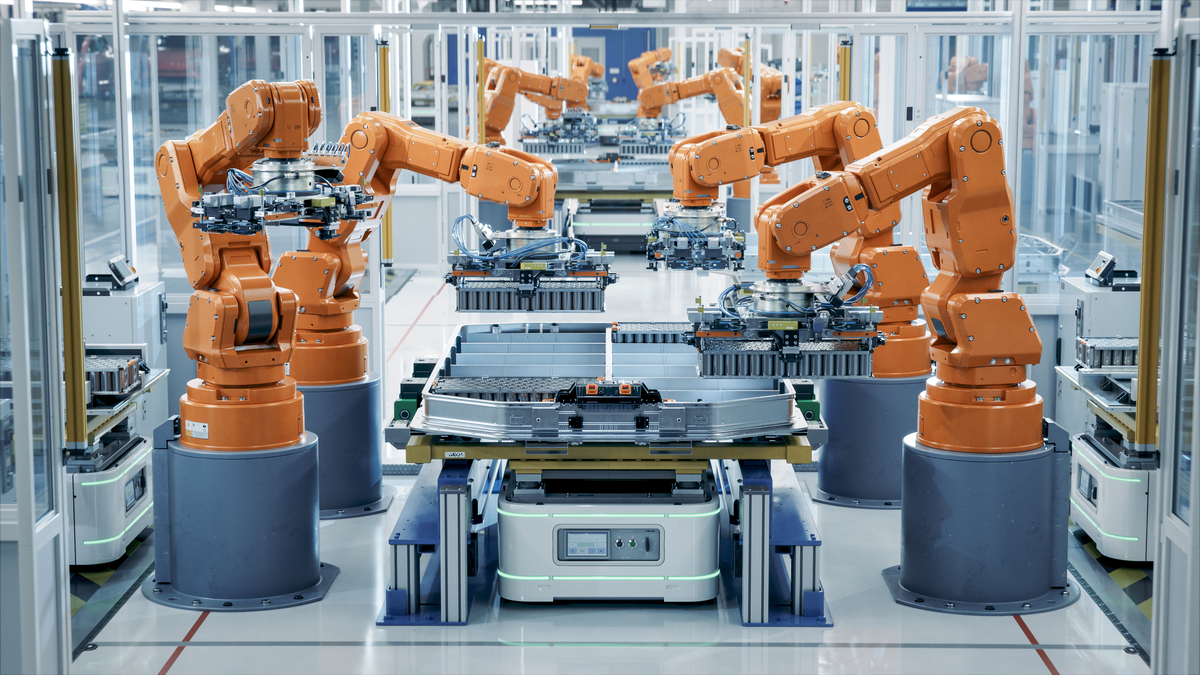

Image Source: Getty Image.

Can Trump Bill really help the rivian?

It should be emphasized that Trump’s bill is still a bill to eliminate EV tax credit. This is a long way to become a law. But if these eliminations are applied, it is expected that EV’s demand will fall in the near period. EVS are already struggling to maintain cost competition vs. gas or diesel engine. Adding $ 4,000 to $ 7,500 to the final cost should eliminate many potential buyers, especially those who are seeking long -term cost savings. The rivian automotive regulator also produces “free” income by selling credit – a major factor of the company receives positive gross margin in recent quarters. Like Tesla, however, most of these credits are earned by state programs such as California, which is not likely to cut them soon.

The noteworthy thing here is that most North American vehicle manufacturers have not yet an affordable electric vehicle on the market, although most are trying. Consider Lousid groupThe purpose of which is to release many new mass market vehicles in the coming years. The company has cash less than $ 2 billion on the balance sheet, and to bring these cars to the market, it will definitely require more capital. If its existing luxury models become even more expensive, it can reduce the demand and capital access to the market, which can really make it difficult for the company to bring its affordable model to the market. It is very possible that the company can withstand serious financial uncertainty, these tax incentives should be abolished.

The rivian, in the meantime, unlike lucids, is already beneficial on the basis of a gross margin, although it partially rely on the federal motor vehicle regulatory credit to achieve it .. It is also far ahead in the development of its inexpensive models than lucids, which is more likely that it actually leads these models. If other contestants struggle financially due to less EV tax encouragement, it is possible that the rivians can achieve long -term. However, it should be noted that in the short term, the rivians should hit direct demand.

The result is a mixed bag for the rivians. Demand will decline due to high costs for consumers. But reducing competition and investment by peers such as lousid group can open a longer -term market share.

Ryan Vanjo There is no situation in any shares mentioned. The micle flower has the position and recommends Tesla. Motale flowers recommend Volkswagen AG. Motley is near the flower Disclosure policy,