Unlock the editor’s digestion for free

FT editor Rula Khalf, selects his favorite stories in this weekly newspaper.

The US dollar has been leading for its first half of the year since 1973, as Donald Trump’s trade and economic policies have inspired global investors to rethink their risk to the world’s major currency.

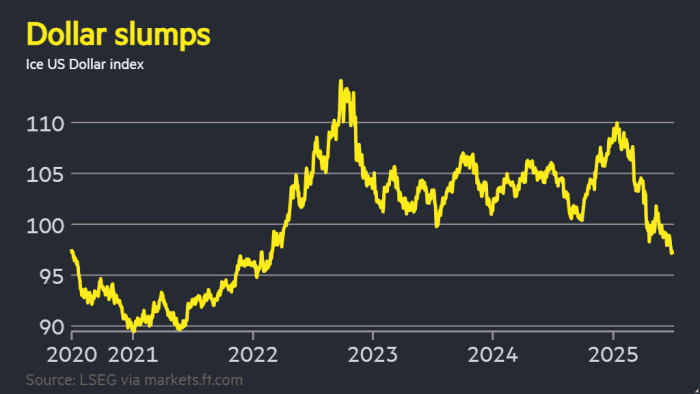

The dollar index, which measures the strength of the currency against the basket of six others, including the pound, euro and yen, has reduced to more than 10 percent in 2025, which is the worst start since the end of the Gold-back-back Breton Woods system.

“Dollar has become a whipping boy of irregular policies of Trump 2.0,” said FX strategist Francesco Pesol in ING.

President’s stop start Tariff warHe said that America’s huge borrowing needs and concerns about Federal Reserve freedom had reduced the dollar appeal as a safe shelter for investors.

The currency was 0.3 percent lower on Monday after being ready to start the American Senate Voting on amendment For the “big, beautiful” tax bill of Trump.

The Landmark law is expected to add $ 3.2TN to the US debt pile in the coming decade and has fulfilled concerns over the stability of Washington’s borrowings, causing a migration from the US Treasury market.

DollarThe sharp fall for the worst first half of the year since the 15 percent defeat in 1973 kept it in the course and performed the weakest in a period of any six months since 2009.

The slide of the currency has confused widespread predictions at the beginning of the year that Trump’s trade war will cause more damage to economies outside the US, strengthening the currency against its rivals, promoting American inflation.

Instead, the euro, which many Wall Street Banks were predicting this year, will fall into equality with dollars this year, increased to 13 percent to above $ 1.17 as investors have focused on the risks of development in the world’s largest economy – while demands have increased for safe assets elsewhere, such as German bonds.

“You suffered a setback in terms of liberation day in terms of the US policy structure,” said Andrew Balls, Chief Investment Officer of Global Fixed Income at Bond Group Pimco.

There was no significant threat to the dollar condition because the world’s real reserved currency, balls argued. But “This does not mean that you cannot be a significant weak in the US dollar”, he said, highlighting your dollar exposure among global investors, highlighting a change to hedge more activity that reduces greenback itself.

Also this year is to push the dollar less Rising expectations According to the levels contained by futures contracts, Feds more aggressively cut rates to support the US economy-urged by the plump-with at least five quarter-bindu cuts by the end of August year.

Bet at low rates has helped us stock the concerns of trade war and conflict in the Middle East to reach a record high level. But weak dollar means that the S&P 500 is far behind rivals in Europe when the returns are measured in the same posture.

Pension funds for the Central Bank Reserve Managers have expressed their desire to reduce their risk for dollars and American assets, and questioned whether the currency is still providing a shelter from market swings.

“Foreign investors require more and more FX hedging for the dollar-sect assets, and this is another factor that prevents the dollar from following the US equity rebounds,” said Pesol of ING.

Sleep This year has also hit the record higher about the depletion of their dollar assets by central banks and other investors.

The dollar recession has taken it to its weakest level against rival currencies over three years. Given the speed of decline, and the popularity of recession dollar bets, some analysts hope to stabilize the currency.

“A weak dollar has become a crowded trade and I suspect that the fall will slow down,” said Gai Miller, the main market strategist at the Insurance Group, and I suspect that the fall will slow down. “