Unlock the editor’s digestion for free

FT editor Rula Khalf, selects his favorite stories in this weekly newspaper.

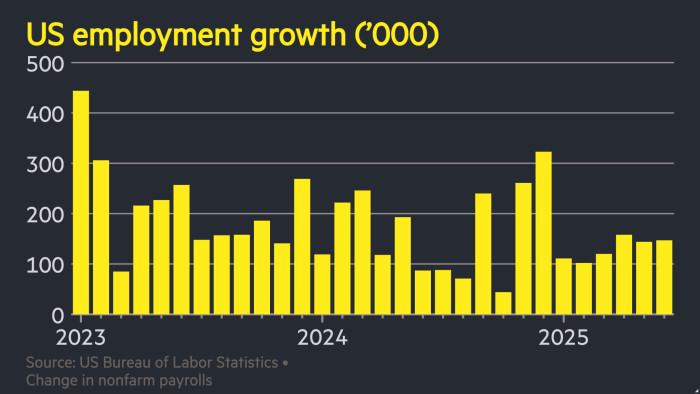

The US economy added 147,000 jobs in June, broke through expectations and to return their stakes on the interest rate cut to lead investors.

Despite Donald Trump’s uncertainty on trade and immigration policies, Thursday’s Thursday’s figures extended 144,000 posts added in May and predicted 110,000 estimated by economists voted by Bloomberg.

The unemployment rate fell slightly to 4.1 percent.

Unexpectedly strong figures will reduce the pressure on the US Federal Reserve to cut interest rates, despite that the US President’s central bank will be repeatedly called to call repeated calls.

The dollar climbed after publishing data as investors made a condition that the fed rates would reduce the rates more gradually. The currency was 0.5 percent compared to a basket of rivals.

Traders are now betting that the US Central Bank has about 5 percent of the possibility of lowering the commission cost this month, compared to about 25 percent before the jobs.

Fed Chair Jai Powell Said this week One July cut was not “far from the table”, in a clear reversal in its previous position that the cost of the borrowing should be held until the autumn.

The two -year Treasury yield, which is unlike interest rate expectations and prices, rose 0.09 percentage points to 3.87 percent on Thursday morning.

US stock futures also increased, with a contract to track the S&P 500 from New York Open to 0.2 percent further.

This is a developing story

![BENTOBEN Magnetic for iPhone 14 Pro Case [Compatible with Magsafe] Translucent Matte 14 Pro Phone Case Slim Shockproof Women Men Girls Boys Protective Cover Cases for iPhone14 Pro 6.1″, Forest Green BENTOBEN Magnetic for iPhone 14 Pro Case [Compatible with Magsafe] Translucent Matte 14 Pro Phone Case Slim Shockproof Women Men Girls Boys Protective Cover Cases for iPhone14 Pro 6.1″, Forest Green](https://digihuntzz.com/wp-content/uploads/2025/07/71q1Ndgi8FL._AC_SL1500_.jpg)