The annual global GDP (GDP) now does yoga at Ballpark in $ 110 trillion. It is not surprising that with so much economic activity, the major businesses dealing with anything related to financial services should also be extremely valuable. The proof is in numbers.

There is no shortage of Large -scale financial enterprise To take huge market cap. For example, Visa ,V -5.01%, Currently, a jaw is worth $ 725 billion. It is one of the largest companies on the face of the planet without a doubt.

But is this stock, which has increased by 36% in the last 12 months (till 12 June), buy a smart now? What investors should know here.

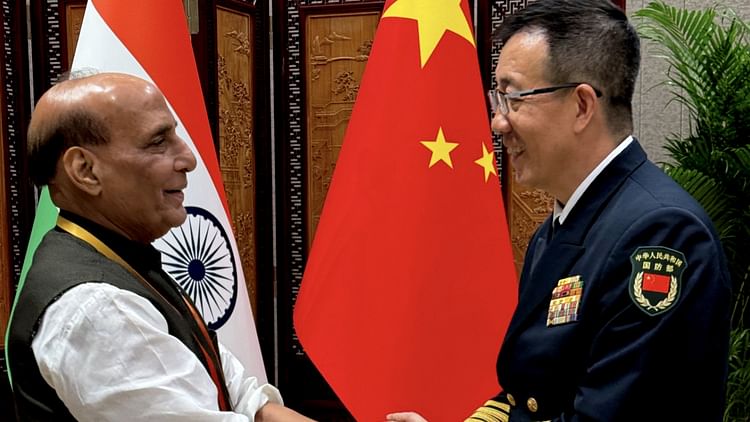

Image Source: Getty Image.

Visa speed continues

Perhaps the best word to describe this year is “uncertainty”. Running trade talks have inspired Fear about a recessionWe saw the play with the first market tanking in 2025, although it is well cured. Investors are smart to think that this adverse economic background must probably have negative impact on the financial performance of companies.

But the visa stands out here. FY 2025 During the second quarter (ended on 31 March), the major payment platform posted 9% year-on revenue growth. This strong border was powered by cross volume, which has been a normal phenomenon.

CEO Ryan McInenie said, “Consumer expenses were also flexible with macroeconomic uncertainty.”

It is one of the most profitable businesses. The net profit of the visa was 48% in the margin Q2, and over the last five years, it has an average of a stellar 52%. Running a scale payment network is proving to be a very attractive effort.

Looking forward, investors have every reason for being optimistic that development will continue. Visa benefits from increasing adoption of digital payments at the cost of cash and paper-based methods. And as the economy expands, activity is spent. All this helps the visa handle over the amount of pay, which was $ 3.9 trillion in the most recent financial quarter.

It is impossible to obstruct

Just because there are large -scale financial businesses, this does not mean that young rival cannot emerge. In the last decade, Fintech companies have succeeded by taking advantage of technology to provide extraordinary user experiences to their customers. In the bus payment industry, Papail, block, AdenAnd Shopify Come to mind.

You feel that these small businesses will make a serious dent in the operation of the visa. However, this is not the case. Since the visa is very inherent in global commerce, the rise of Fintech Enterprises can be seen as more use of the card legend’s platform. This is because they make it even easier to adopt cashless transactions.

Also, powerful visa Network effect Its competitive situation is almost unavailable. The system works well for traders, of which more than 150 million plugged visa networks, and cardholders, which carry 4.8 billion visa cards worldwide. Both stakeholders appreciate the group facility and safety visa offer, not to mention how omnipresent the network is.

As long as no new system is pop up, it is 10 times better than which is now available, I am quite confident that the visa will not only be relevant, but will continue to lead the future payment landscape.

Can Visa Stock defeat the market?

Visa shares have crushed S&P 500 In the last decade, the total return of about 500%produced. But I am not sure it will continue to perform better because we look forward. The huge size of the company gets on the way.

Evaluation is another major component that investors should be a factor in their decision -making process. On Visa Stock Trade A Price-to-earning ratio Of 37.4. It represents a premium for an average of five- and 10 years. Investors who want a huge return should wait for a large -scale pullback.

Neil Patel There is no situation in any shares mentioned. The micle flower has a position of aden, block, papail, shopfi and visa. Motale flowers recommend the following options: Long on Paple January 2027 $ 42.50 calls and June 2025 $ 77.50 calls on Payal. Motley is near the flower Disclosure policy,